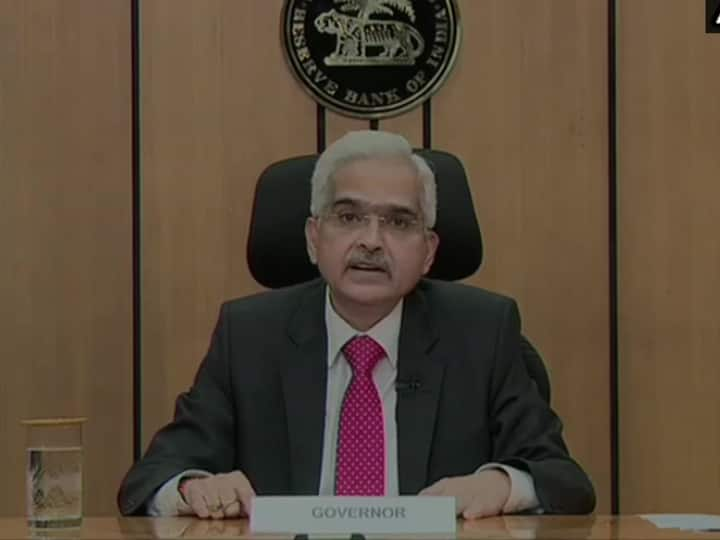

Reserve Bank of India Governor, Shaktikanta Das on Wednesday announced that the second purchase of government sector for Rs 35,000 crore will be conducted on May 20.

In a press conference, Shaktikanta Das said that Reserve Bank of India will continue to monitor the emerging COVID19 situation and will deploy all resources and instruments at its command especially for the citizens, business entities, and institutions beleaguered by the second wave. “The devastating speed with which the virus affects has to be matched by swift and wide-ranging actions that are sequenced, calibrated and well-timed so as to reach out to various sections including the most vulnerable,” the RBI Governor said.

Here are the major announcements made by RBI Governor Shaktikanta Das:

- RBI announces Rs 50,000 crore liquidity for ramping up COVID-related healthcare infrastructure and services till March 2022

- RBI measure enumerates the liquidity of Rs 50,000 crore to the banks with a tenure of 3 years for healthcare for quick delivery of priority sector lending till March 31, 2022.

- The 2nd purchase of govt sec for Rs 35,000 crore will be conducted on May 20

- COVID loans book to be created by the banks at 25 bps lower than the repo rates

- Lending by small finance banks to the MFIs will be classified as priority sector lending till 31st March 2022

- The forecast of a normal monsoon by IMD is expected to sustain rural demand and overall output in 2021-22, while also having soothing impact on inflation pressures

- Rail freight registered growth of over 76% yr on yr in April. Toll collections in April suggest mobility declined but unlike abrupt halt during April 2020. Automobiles registration in April 2021 shown moderation compared to March. Tractor segment continues robust pace

- Normal monsoon should help contain food price pressures, especially in cereals and pulses. Merchandise imports and exports continue to witness robust growth performance, even in April 2021. Foreign exchange reserves give us confidence to deal with global spillovers

- With the resurgence of the COVID-19 pandemic, individuals, small borrowers, and MSMEs with to loan of Rs 25 lakh will be allowed for restructuring up to September 31, 2021

- Build-up in input price pressures across sectors, driven in part by elevated global commodity prices remains a concern. Inflation trajectory over rest of the yr will be shaped by COVID19 infections & impact of localised containment measures on supply chains & logistics

- Special long term repo operations for small finance banks to provide further support to micro, small & other unorganized sector entities,3-yr repo operations of Rs. 10,000 crore at repo rate, for fresh lending up to Rs 10 lakh per borrower;facility up to 31 Oct’ 21

- In view of fresh challenges, Small Finance Banks are now permitted to regard fresh on-lending to MFIs with asset size up to Rs 500 crore, as priority sector lending, facility available up to 31 March, 2022

- Given the positive response from the market, it has been decided that the second purchase of govt securities for an aggregate amount of Rs 35,000 crores under G-SAP 1.0 will be conducted on 20th May

Source link